Lately I was focused on understanding the way French companies work, how are taxes paid, and how to best choose companies’ statuses based on this. I wanted to have real figures and understand where does money go when ruling a company.

Basically I endorsed the “expert-comptable” cap for a few weeks and delved into law texts, official government agencies, taxes administration, entrepreneurs helping agencies, several “expert-comptable” advices and so on.

First, I couldn’t realize how complex it can be before searching by myself, and the first impression I got was: “Nobody knows, the field is too complex and so badly written in the law.”

… And sadly this impression was later confirmed: any expert I consulted on the topic has a different and contradictory information on the state of the law, and a lot of them gave me wrong advices. Always cross-check any information you get with at least 3 or 4 different sources (this post is no exception), and do not rely too much on self-evidences, as they very often prove wrong either.

This being said, here is my view on the topic: this is a very simplified view, but can be used as an overall base to understand the process, and later delve into details and local exceptions to this big picture.

I will quote French words as their meaning can be really precise and important.

Please note that this study has been made during summer 2012. As French law changes very often, it is possible that parts of this post will be outdated soon.

If you happen to find wrong information, please do not hesitate to comment on it, I will be really glad to correct it.

Table of contents:

- French companies categories

- Where does the money go ?

- Some figures

- A nice spreadsheet computing and comparing statuses

- Resources for further investigations

French companies categories

In France, there are 2 kinds of companies: “Entreprises” (handled by physical people), and “Sociétés” (existing as moral persons). People ruling a company are called “Associés”. Usually “Entreprises” comprise just 1 “Associé”, whereas “Sociétés” comprise 1 to an infinite number of them (either physical or moral). Whatever the form and the number of “Associés”, a company can always hire “Salariés” (wage-earning) people to whom you give salaries.

Usually, “Sociétés” (and the “EIRL” type of “Entreprise”) have a dedicated sum of money (called “Réserve” or “Patrimoine”) that is formed by the “Associés” (people ruling the company). This money belongs to the company itself, and is not taxed unless given back to the “Associés”. As “Associés” may have contributed to the “Patrimoine” in different sums, each “Associé” is affected a “Quote-part” of the company: this is the percentage of its provision to the “Patrimoine”. This “Quote-part” then defines whether the “Associé” is majority (>50%), minority (<50%) or egalitarian (=50%).

French companies have then 3 different attributes that govern how they will pay taxes:

- The “Régime social” (social scheme) of it “Associés”: Depending on the company’s status, its “Associés” will have a specific social status, giving them different rights to social protection, and making them pay taxes differently. The 3 social statuses “Associés” can have are:

- “Travailleurs Non Salariés” (TNS): usually given to “Associés” being majority in the affected “Patrimoine”,

- “Assimilés Salariés” (AS): usually given to “Associés” being minority or egalitarian in the affected “Patrimoine”,

- “Micro-social”: a specific status dedicated to some “Micro-entreprises” (a type of “Entreprises” comprising just 1 “Associé” and having its benefits capped to something less than € 85 000 – limit depends on the company’s activity). With this status, social contributions are paid based on a percentage of the total “Chiffre d’Affaires”.

- The “Régime fiscal” (fiscal scheme) of the company. This scheme governs the way taxes on the company’s benefits are paid. 2 possibilities:

- “Impôt sur le revenu” (IR): This makes the “Associés” pay taxes on the company’s benefits, as if these benefits were perceived as salaries by each “Associé” (taxes will be payed even if no salary is given). With the “IR” fiscal scheme comes an option called “Prélèvement libératoire”, allowing the “Associés” to pay taxes as a percentage of the company’s “Chiffre d’Affaires” ; this option is only possible for “Micro-entreprises” that have “Associés” belonging to the “Micro-social” social scheme.

- “Impôt sur les sociétés” (IS): This makes the company itself pay taxes on its benefits.

- The part of the company’s benefits that will be subject to taxes (“Bénéfices imposables”) can also differ. 2 possibilities:

- “Régime réel” (real scheme): Real benefits will be taxed, meaning the “Chiffre d’Affaires” minus the expenses, salaries and some social contributions,

- “Micro-entreprise” (not to be confused with the “Micro-entreprise” type of “Entreprises” – I know it reads the same, but here we are talking about the way benefits are taxed): taxes will be computed based on a percentage of the total “Chiffre d’Affaires”. If your company has a lot of expenses, this is not a good option to take, as you will pay taxes on them.

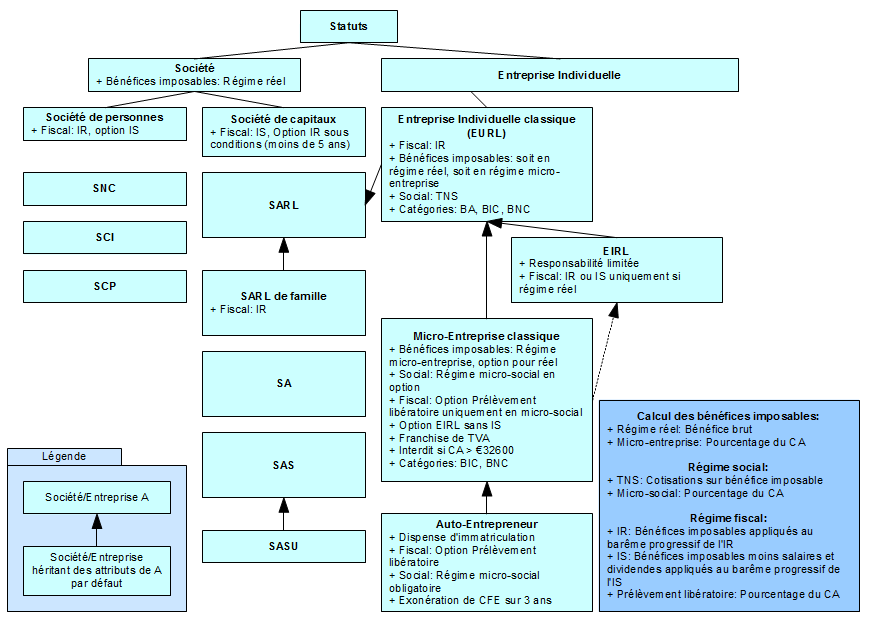

The following diagram sums the different companies’ statuses and their specific attributes (it is not exhaustive, but gives the main statuses encountered):

Where does the money go ?

Each year, a French company sums up the money taken from its clients as a “Chiffre d’Affaires” (CA). This money is then shared among the following:

- Expenses, needed for the company to work,

- “Salaires” (salaries) given to the “Salariés” or “Assimilé Salariés”,

- “Rémunérations”, given to the “Travailleurs Non Salariés”,

- “Dividendes”, given to any “Associé”,

- social contributions, payed for any physical people working at the company (“Associé”, “Salarié”),

- social contributions to the director’s wife/husband if accepted as a contributor to the company,

- “Impôt sur les sociétés”, a tax usually paid by the “Sociétés” on their benefits, and

- “Mise en réserve”, the rest of the “Chiffre d’Affaires” that will be put to the “Patrimoine” again.

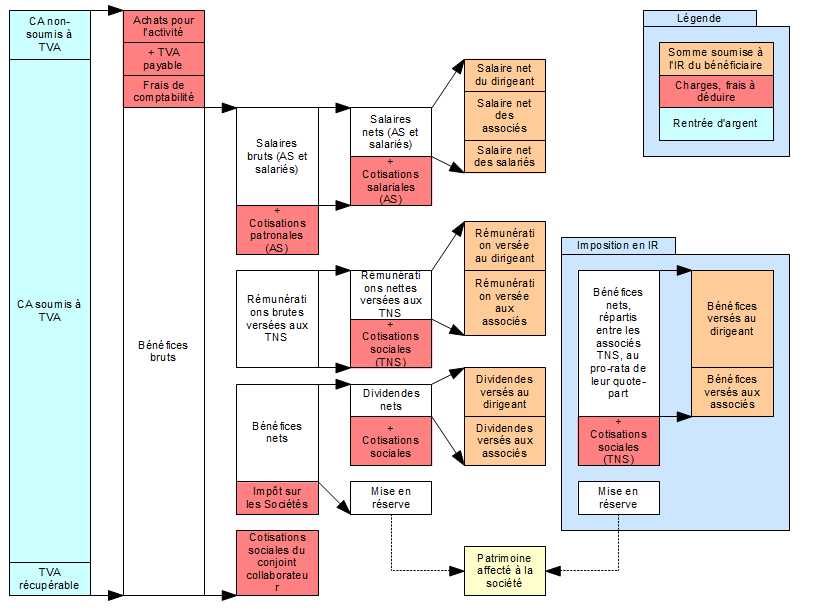

This picture sums up the situation:

There are simple rules to keep in mind while reading this diagram:

- Social contributions are always paid for any person working in the company: “Associé”, “Salarié” and even the director’s wife/husband as a contributor

- Social contributions are also paid for any “Dividendes” given to “Associés”

- If the company’s fiscal scheme is “Impôt sur le revenu”, there are no possible “Dividendes” to be distributed (they can be assimilated as “Rémunération”), and there is no “Impôt sur les sociétés” to be payed by the company.

- Social contributions for “Salaires” are computed based on the “Salaire brut” (gross salary). They comprise a part paid by the company, and a part paid by the wage-earning. Therefore the salary given on the wage-earning bank account (“Salaire net”) equals the “Salaire brut” minus the social contributions’ part paid by the wage-earning. The wage-earning will then pay taxes on this income later.

- Each sum of money given to a “Salarié” or “Associé” is taxed on the person’s end (not the company’s), as an income (“Salaires”, “Rémunérations” and “Dividendes”). Taxes on those incomes are computed using the “Impôt sur le revenu” (IR) scheme.

Some figures

To help you better figure out the costs involved, here are some figures I can broadly give during the year 2012.

Those figures were computed having in mind a “Chiffre d’Affaires” of € 200 000.

Social contributions

- Social contributions paid for a “Travailleur Non Salarié” having a “Rémunération” of € 100 000 is around € 30 000

- Social contributions (counting both the company and wage-earning parts) paid for a “Assimilé Salarié” having a “Salaire net” (deposited on the wage-earning bank account) of € 100 000 is around € 85 000

- Social contributions (counting both the company and wage-earning parts) paid for a “Salarié” having a “Salaire net” (deposited on the wage-earning bank account) of € 100 000 is around € 100 000

- Social contributions paid for a “Dividendes” amount of € 100 000 is exactly € 15 500

- For the “Micro-social” social scheme, social contributions equal a direct percentage of the “Chiffre d’Affaires”, depending on the company’s activity:

- 12.3% for “BIC” activities dealing with sales

- 21.6% for “BIC” activities dealing with services

- 21.5% for “BNC” activities

- 18.3% for special “BNC” activities (dealing with “Cipav”)

Taxes on incomes and societies

- The “Impôt sur le revenu” works in layers. To each layer of the sum to be taxed (monthly) corresponds a rate giving the tax amount applied on this layer.

- € 0 <= x <= € 5 963: 0%

- € 5 963 < x <= € 11 896: 5.5%

- € 11 896 < x <= € 26 420: 14%

- € 26 420 < x <= € 70 830: 30%

- € 70 830 < x: 41%

Please note also that the layers apply to a fraction of the taxed sum: a first deduction of 10% for professional expenses, and divided by the number of parts in your family (alone: 1 part, a couple: 2 parts, a couple with 1 child: 2.5 parts …). The computed tax is then multiplied back by the number of family parts.

As an example, if a couple earns € 50 000 a year, here is the computation of its “Impôt sur le revenu”:- Remove 10%: € 45 000

- Divide by number of family parts (2): € 22 500

- Compute taxes per layers up to € 22 500: ( 0% * € 5 963 ) + ( 5.5% * ( € 11 896 – € 5 963 ) ) + ( 14% * ( € 22 500 – € 11 896 ) ) = € 0 + € 326.315 + € 1 484.56 = € 1 810.875

- Multiply by number of family parts (2): € 3 621.75

- The “Impôt sur les sociétés” also works in layers, the same way “Impôt sur le revenu” does (without deductions):

- € 0 <= x <= € 38 120: 15%

- € 38 120 < x: 33.33%

- For the “Micro-entreprise” fiscal scheme, the part of the “Chiffre d’Affaires” used to compute taxes differs depending on the company’s activity. They take the whole “Chiffre d’Affaires”, minus a percentage of it:

- 71% for commercial activities dealing with sales (“Bénéfices Industriels et Commerciaux” – “BIC” with sales)

- 50% for commercial activities dealing with services (“BIC” with services)

- 34% for non-commercial activities (“Bénéfices Non Commerciaux” – “BNC”)

This reduction can’t be less than € 305.

- The “Prélèvement libératoire” option that can be chosen for paying taxes for “Micro-entreprises” also using the “Micro-social” social scheme, is computed using an exact percentage of the total “Chiffre d’Affaires”, also depending on the company’s activity:

- 1% for “BIC” activities dealing with sales

- 1.7% for “BIC” activities dealing with services

- 2.2% for “BNC” activities

Others

- The company’s status “Micro-entreprise” has a limitation on its “Chiffre d’Affaires”. If it exceeds a certain limit, the company has to change statuses. This limit also depends on the company’s activity:

- € 81 500 for “BIC” activities dealing with sales

- € 32 600 for other activities

A nice spreadsheet computing and comparing statuses

As a part of my study, I created a nice spreadsheet that references the main company statuses with their characteristics.

Then, for each (or all) company status(es), you can enter figures (“Chiffre d’Affaires”, number of associates, expenses, salaries…), and the spreadsheet will compute the social contributions, benefits, taxes and incomes for each “Associé”.

It follows the diagram given above and shows all details about social contributions and computations. It can be a bit daunting at first but can prove really useful.

You can use this spreadsheet to compare the different statuses depending on your situation.

Comparatif Statut Entreprises

Resources for further investigations

Here are some links to resources I found very helpful during my study.

However please be aware that you might find wrong, obsolete and contradictory information in a lot of them: you will have to cross-check them to get the real picture.

- Comparison of companies’ statuses:

- “EIRL”

- Status of “Auto-entrepreneur”:

- Social status of the director

- Status of the director’s wife/husband

- Advantages of joining a “Centre de Gestion Agréé” (“CGA”)

- Compute taxes and social contributions

- Useful softwares in helping creating its own company

- Administrative steps to create your own company

- Complete folders on companies’ creation

Hope this will help others making their mind on those really complex statuses.